They are the main candidates for divestment because they are a money trap for the company. If the market is going into a decline soon, discarding the Dogs make the most sense.

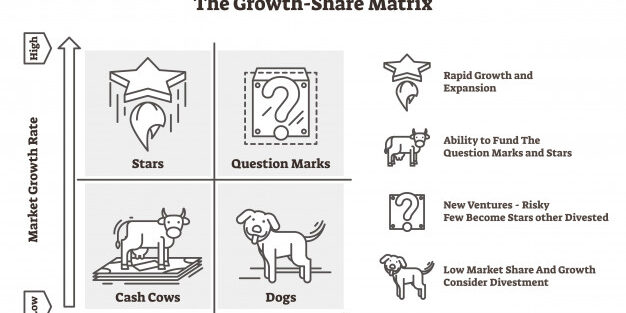

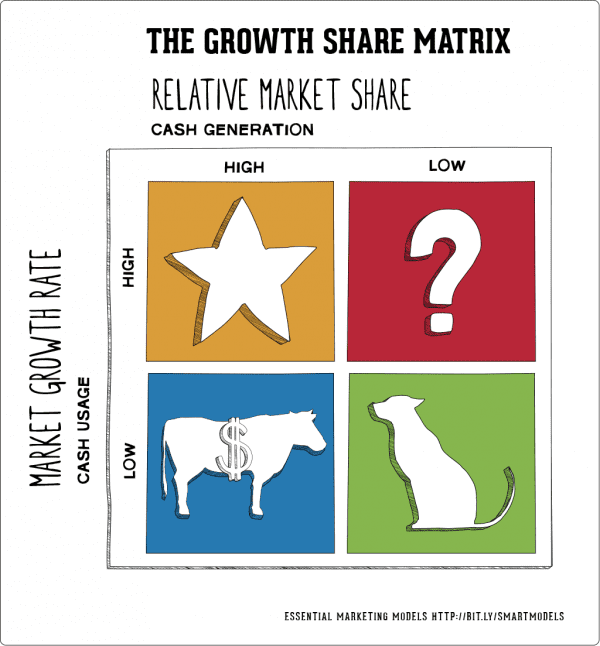

That will likely lead to a price war as competitors will also take steps to defend their positions. Say, the company launched a low price to attract more competitors’ customers. Of course, competitors, especially market leaders, are unwilling to lose their dominance. That means the additional profits may not be as big as the costs that the company incurs.ĭue to low growth, any strategic move to increase market share is likely to provoke a strong competitive reaction. It is more difficult if it involves high switching costs because customers are loyal to competing products.įurthermore, such efforts may be in vain if the market turns into a decline stage immediately. Instead, they will try to extract cash as quickly as possible by selling production equipment and reducing advertising spending.Īttempts to seize market share from competitors require significant resources. However, companies rarely invest in this category because it is unfeasible. The Dog probably made enough money to break even. As a result, the company must bear a higher unit cost than competitors. Production capacity is less optimal due to low sales volume. Low market share means the company sells fewer goods and generates less revenue. Hence, to increase their market share, a possible solution is to grab customers from competitors.ĭogs generally have a low gain. Therefore, the primary source of growth was from repeat purchases, not from increasing new customers.Īs new customers became increasingly rare, companies faced difficulty growing sales. Almost all consumers have used or purchased the product. They prefer competitors’ products because they are better, for example, because they are cheaper, more unique, or even because of superior customer service.įurthermore, low growth indicates a market that has entered a mature stage. Consumers do not like it because of poor product quality and features or high prices. What does Dog mean and what are the consequences for the companyĪ low market share indicates the product is less competitive. Still, companies need relatively more considerable investment. High market growth indicates that such a move (increasing market share) is possible. Companies should build and strengthen this category to gain a dominant position in the market. Question mark – a product category with a low market share and in a high-growing market.By doing so, companies can ensure sustainable growth. Companies can use them to invest in Star or Question marks to become the next cash cow. This category should generate large cash flow for the company. Cash cows– a product category with a high market share and operating in low growth markets.It requires less investment than the Question mark.

A sensible strategy is to maintain or even increase this product’s market share until the market reaches a mature stage. It has the potential to become the next cash cow.

0 kommentar(er)

0 kommentar(er)